The Defense Department’s annual spending bill currently includes a requirement for a report on the impact of offshore wind’s on national security, and a description of options to mitigate the impacts. There is similar language in the Interior Department spending bill that urges “thorough consideration and accommodation of all affected interests including national defense, security, environmental, maritime safety, fisheries, and particularly locally affected community concerns.”

Why This Matters: The wind energy industry association is concerned (rightly so) that the creation of this new report would cost staff time, taxpayer money, and create uncertainty for offshore wind development. They also argue that these possible conflicts are already considered in the wind energy siting regulatory process. The wind energy industry is growing tremendously and the most recent offshore lease sale brought in more than $400 million to the U.S. government, and more government revenue is possible in future sales provided that they are not blocked by DoD. These same national security issues have successfully impeded the development of offshore oil and gas drilling. But national security tends to win any time they go to battle with other government interests. This study could throw cold water on offshore wind development.

- “With tens of thousands of U.S. jobs, a $70 billion dollar supply chain opportunity, and the security that comes with additional American clean energy on the line, we urge Congress to reject this needless language.” – Tom Kiernan, CEO of the American Wind Energy Association

- Wind developers claim they have successfully mitigated impacts on military radar or training exercises when they occur or otherwise do pursue projects the DOD identifies as being in conflict with military readiness.

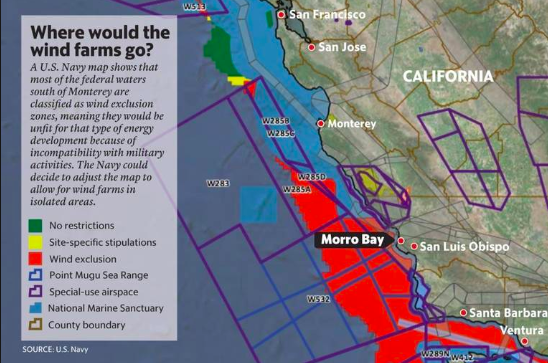

At the end of 2018, the U.S. had a total offshore wind pipeline of over 25,000 MW, spanning 10 states off the East and Great Lakes coasts. A recent study from the University of Delaware’s Special Initiative on Offshore Wind found that there is nearly $70 billion in potential revenue and tens of thousands of jobs in U.S. offshore wind businesses and the supply chain. The Defense Department has produced maps showing where they do not want offshore energy development and these areas of military operations span much of both the east and west coasts.

May 27, 2019 » American Wind Energy Association, Navy, offshore wind, wind farms